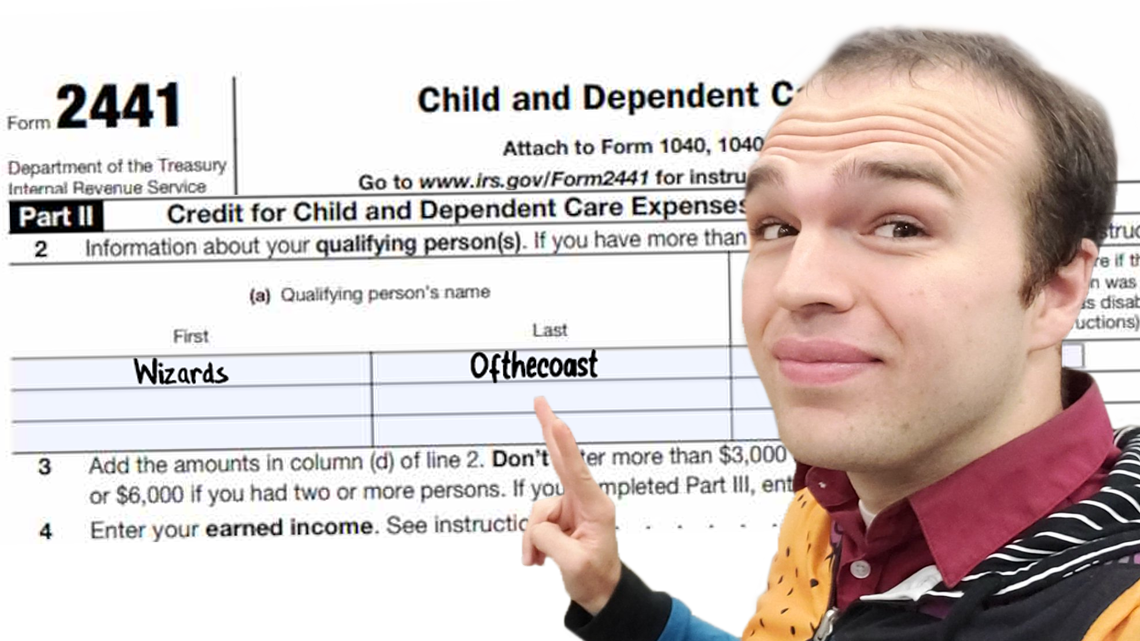

Gavin Verhey Claims Hasbro as a Dependent on His Tax Forms

Renton, WA – With tax season heating up, Commander’s Herald sent this reporter to the hometown of Wizards of the Coast in search of hot tips for Magic: The Gathering players, content creators, and other financially illiterate-types. I met with Ffej Netrig, CPA and personal accountant to Gavin Verhey, Principal Game Designer for MTG.

The following is a record of our brief conversation which Netrig did his best to quickly derail:

“With tax day only a couple weeks away, is there any general advice you offer to Magic players?”

Netrig: “I’ll tell you what I told Gavin: the best thing you can do is find a way to write off your cardboard crack. Whether it’s putting your collection in a trust, claiming bad booster boxes as a capital loss, or even just adding a dependent to increase your standard deduction.”

“Adding a dependent?”

Netrig: “Yeah, that’s what I told Gavin to do this year: claim Hasbro as a dependent on his tax forms.”

“You told the Principal Designer of Magic: The Gathering to claim his parent company as a dependent? Isn’t that fraud?”

Netrig: “That’s exactly what I told him to do, and I leave it to the courts to decide what ‘fraud’ really is. If corporations are people and money is speech, then we should be able to rightfully claim that our corporate overlords are financially dependent on us for tax purposes.”

“So, your interpretation of the Supreme Court’s ruling in Citizens United is that we can all claim our employers are financially dependent on us?”

Netrig: “Why not? Hasbro made $726 million in operating profit last year. I figure that’s all Gavin, baby.”

“I can decide if that’s psychotic or extremely progressive.”

Netrig: “The way I see it, we’re about six months away from The Court declaring we’re all legally the same person for tax purposes, so I figured we’d just roll the bones on this one.”

“So, to get this on the record: you’re advising Gavin to claim Hasbro as a dependent on his tax forms this year?”

Netrig: “Technically I just did it for him. My clients don’t pay me to ask them what to do. They pay me to take action and let them pay for the consequences later.”

“You didn’t ask him ahead of time?”

Netrig: “I’m more of a shoot-from-the-hip type of accountant.”

“You’re definitely going to jail.”

With tax day in America just around the corner, keep your eyes on this space. This reporter is planning to advise Mr. Verhey to seek new representation in his personal financial matters and encourages you to seek qualified financial help for yourself. The IRS is unlikely to accept Reserved List cards as a form of payment for outstanding debts.

A swarm of black SUVs could be seen approaching Mr. Netrig’s offices as this reporter left.

Editor’s Note: Please do not seek financial advice from Mr. Netrig.